January 23rd 2024

Key Takeaways From Our Annual eCommerce Acquirors Conference, New York 2024

Our 2024 eCommerce Acquiror Conference took place January 16th in New York, hosting eCommerce acquirors and financial and operational experts from around the world. The agenda covered macro and sector conditions, acquisitions, operational value creation and a celebration of success stories. We thank our title sponsor Airwallex and all our other sponsors for making this event a success. We look forward to our next annual eCommerce Acquiror Conference in January 2025.

Guest Speakers

Distinguished speakers delivered exceptional presentations, offering multifaceted insights and deep expertise tailored to the evolving dynamics of the ecommerce sector

Expert Panels

Selected panelists, composed of leading industry professionals, engaged in in-depth discussions on key topics.

Audience Polls

Throughout the event, we conducted interactive audience polls among our esteemed attendees, comprising M&A professionals and C-suite executives, which yielded valuable currents insights.

Guest Speakers

Distinguished speakers delivered exceptional presentations, offering multifaceted insights and deep expertise tailored to the evolving dynamics of the ecommerce sector

Expert Panels

Selected panelists, composed of leading industry professionals, engaged in in-depth discussions on key topics.

Audience Polls

Throughout the event, we conducted interactive audience polls among our esteemed attendees, comprising M&A professionals and C-suite executives, which yielded valuable currents insights.

01

eCommerce Environment

Participants

- Furhaan Khan of UBS, Bill Pecoriello CEO of Consumer Edge, and Moritz Thoma, CEO of Grips Intelligence.

Key Takeaways

- UBS, Consumer Edge and Grips Intelligence kicked off discussions reviewing the macro landscape and consumer spending. UBS’s Furhaan Khan expects an economic soft landing as rates taper, along with an increase in deal volumes (given there’s 2.3T of dry powder on the sidelines). That money needs to be invested somehow.

- Based on public company comparables, eCommerce valuations have softened. EV/NTM Sales multiples across all measured eCommerce sectors are down since 2020.

- Consumer spend is forecasted to transition from post covid high sectors such as travel of which consumer goods and retail will benefit.

- Overall consumer spend in general remains subdued by caution towards inflation and interest rates.

- M&A volumes are expected to increase as the cost of capital reduces.

01

eCommerce Environment

Participants

- Furhaan Khan of UBS, Bill Pecoriello CEO of Consumer Edge, and Moritz Thoma, CEO of Grips Intelligence.

Key Takeaways

- UBS, Consumer Edge and Grips Intelligence kicked off discussions reviewing the macro landscape and consumer spending. UBS’s Furhaan Khan expects an economic soft landing as rates taper, along with an increase in deal volumes (given there’s 2.3T of dry powder on the sidelines). That money needs to be invested somehow.

- Based on public company comparables, eCommerce valuations have softened. EV/NTM Sales multiples across all measured eCommerce sectors are down since 2020.

- Consumer spend is forecasted to transition from post covid high sectors such as travel of which consumer goods and retail will benefit.

- Overall consumer spend in general remains subdued by caution towards inflation and interest rates.

- M&A volumes are expected to increase as the cost of capital reduces.

02

Acquirors

Participants

- Session 1 Panellists: Philipp Triebel, CEO of Sellerx, Mark Goldfinger, Growth VP of unybrands, and Ben Cogan the Co-Founder of Agora.

- Insight provided separately by Tushar Ahluwalia, CEO of Razor Group, who have acquired three aggregators [Factory 14, Stryze and Valoreo].

- Session 2 Panellists: WeTheBrands Co-CEOs, Jaschar Hupperth and Nicolai von Enzberg, Olsam Group Co-Founders: Ollie and Sam Horbye.

Key Takeaways

- Announcing 2 New Mergers Of Aggregators:

- The Fortia Group was proud to advise on the merger of WeTheBrands and Mantaro Brands, two German based aggregators.

- Weeks before the conference the eCommerce world learned about the successful merger between Olsam Group and Dwarfs.

- More Than Just M&A: Self-sufficient aggregators are thinking beyond M&A. Surviving players are leveraging their brand portfolios to test & launch SaaS/infrastructure products.

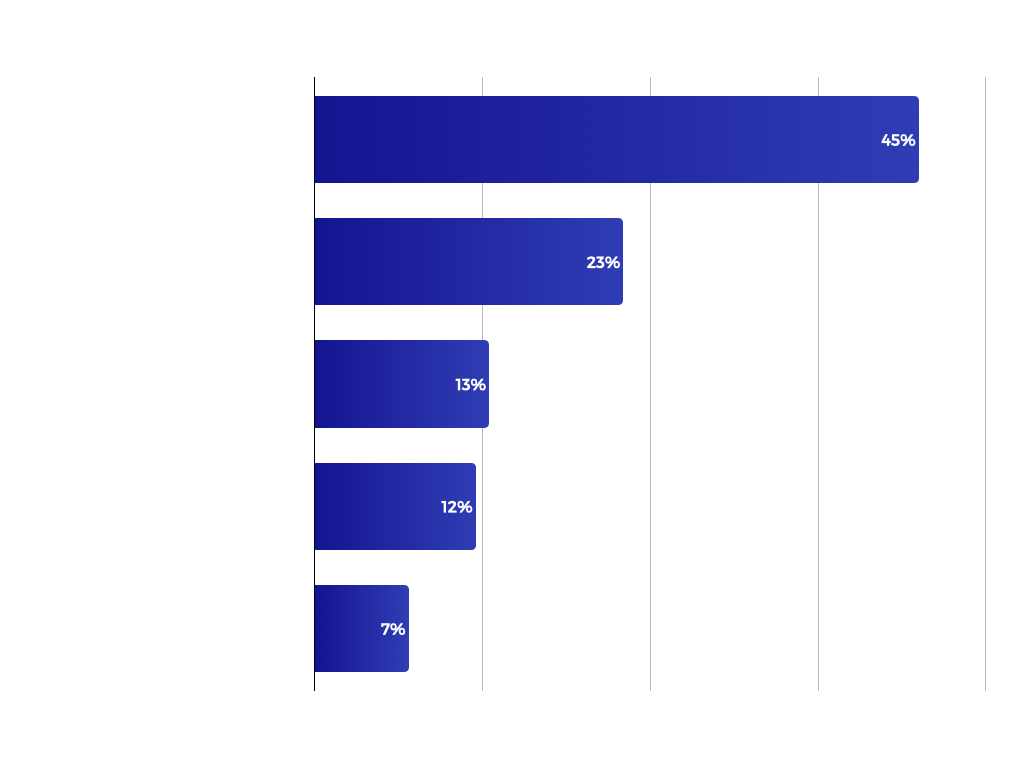

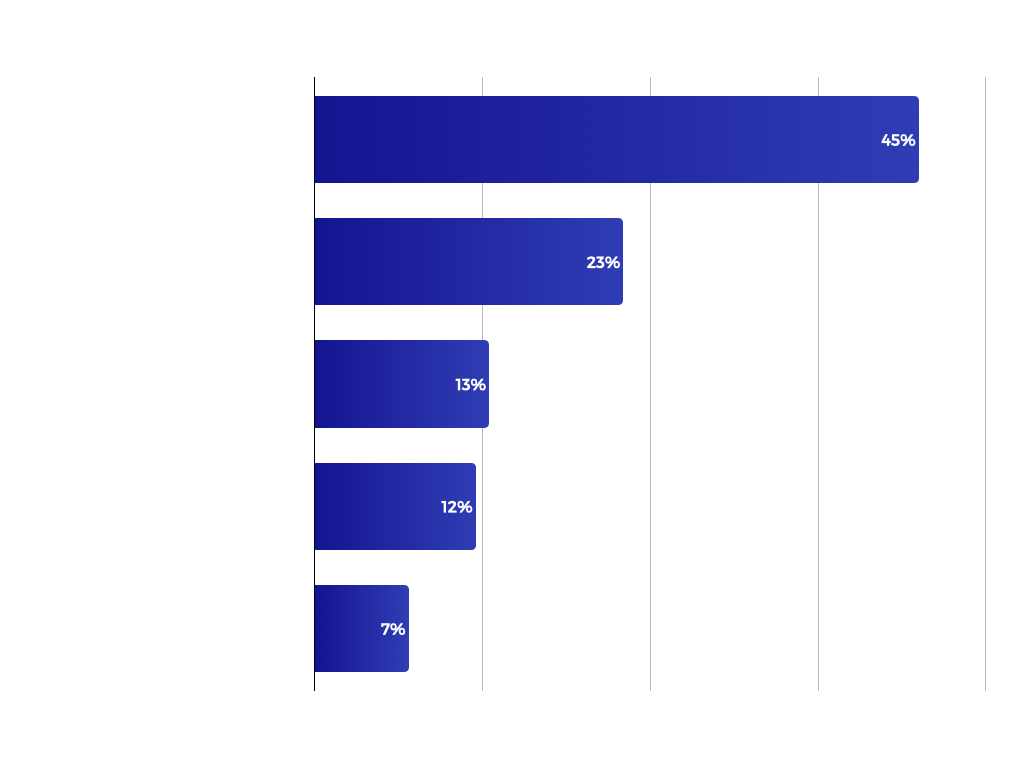

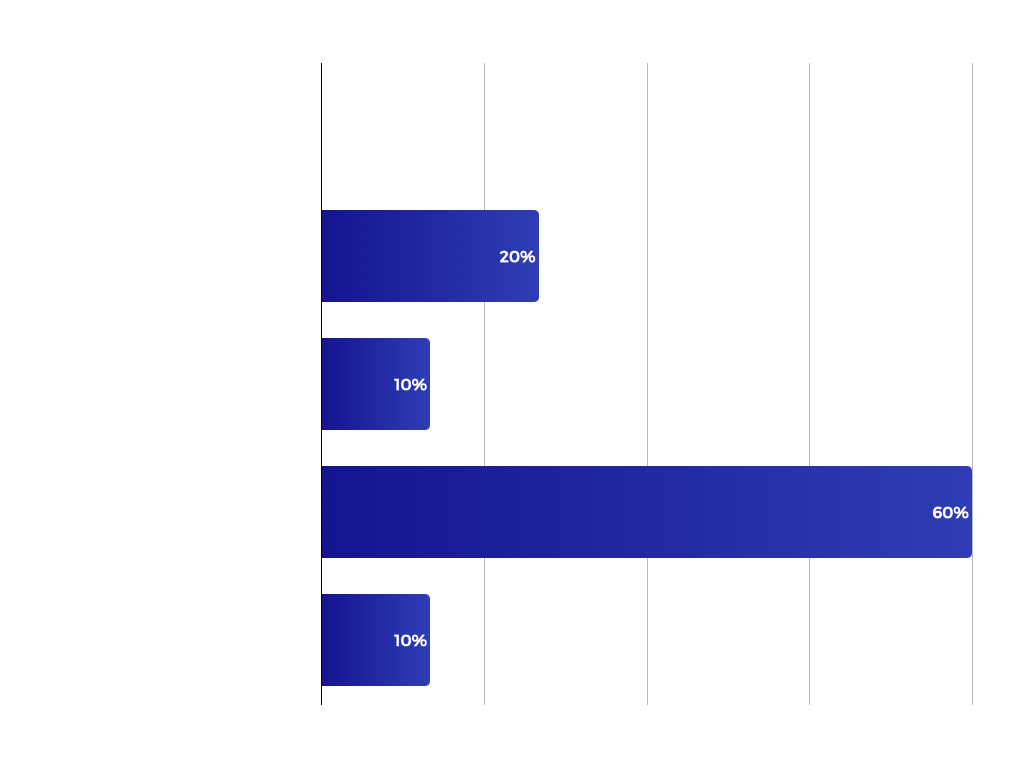

- M&A Trends: More consolidation is expected in 2024. A poll highlighted the main reasons:

- Strengthening balance sheet

- Scale

- Cash

- Leverage

- Group EBITDA

- Challenges of Market Conditions: Panellists discussed the challenges faced over the past year, including lower consumer spending due to inflation, pressure on margins, the rise in interest rates, and the general move towards a survival mode among companies.

- Integration of AI and Technology: panelists discussed three areas where AI is being used: cost savings removing resource requirement on content, customer service benefits by reducing SLA’s pricing and demand planning.

02

Acquirors

Participants

- Session 1 Panellists: Philipp Triebel, CEO of Sellerx, Mark Goldfinger, Growth VP of unybrands, and Ben Cogan the Co-Founder of Agora.

- Insight provided separately by Tushar Ahluwalia, CEO of Razor Group, who have acquired three aggregators [Factory 14, Stryze and Valoreo].

- Session 2 Panellists: WeTheBrands Co-CEOs, Jaschar Hupperth and Nicolai von Enzberg, Olsam Group Co-Founders: Ollie and Sam Horbye.

Key Takeaways

- Announcing 2 New Mergers Of Aggregators:

- The Fortia Group was proud to advise on the merger of WeTheBrands and Mantaro Brands, two German based aggregators.

- Weeks before the conference the eCommerce world learned about the successful merger between Olsam Group and Dwarfs.

- More Than Just M&A: Self-sufficient aggregators are thinking beyond M&A. Surviving players like the Razor Group are leveraging their brand portfolios to test & launch SaaS/infrastructure products.

- M&A Trends: More consolidation is expected in 2024. A poll highlighted the main reasons:

- Strengthening balance sheet

- Scale

- Cash

- Leverage

- Group EBITDA

- Challenges of Market Conditions: Panellists discussed the challenges faced over the past year, including lower consumer spending due to inflation, pressure on margins, the rise in interest rates, and the general move towards a survival mode among companies.

- Integration of AI and Technology: panelists discussed three areas where AI is being used: cost savings removing resource requirement on content, customer service benefits by reducing SLA’s pricing and demand planning.

03

Acquisitions

Participants

- Alex Lukashov, CEO of Fintent,

- Muddy Mat, Johannes Rossner [on behalf of Alpin Loacker and Project Boston),

- Daniel Mc Carthy, Co-Founder at Theta, Paul Hanley, Co-Founder at The Fortia Group and Withum CPAs.

Key Takeaways

- Our Shark Tank Brands Were A Big Success:

- Introducing Muddy Mat – Impressive omnichannel pet brand coming to market in Q1 2024. Matthew, Andrew and Ikho gave a fantastic demo and financial performance overview of the brand.

- Alpin Loacker – Patent protected EU based tech hiking clothing and equipment omnichannel brand.

- Project Boston, EU Headquartered Aggregator – US portfolio. This aggregator wishes to focus on their core business and as such are open to offers for their current US portfolio.

- To learn more about any of the above deals, please contact The Fortia Group directly.

- Introducing Muddy Mat – Impressive omnichannel pet brand coming to market in Q1 2024. Matthew, Andrew and Ikho gave a fantastic demo and financial performance overview of the brand.

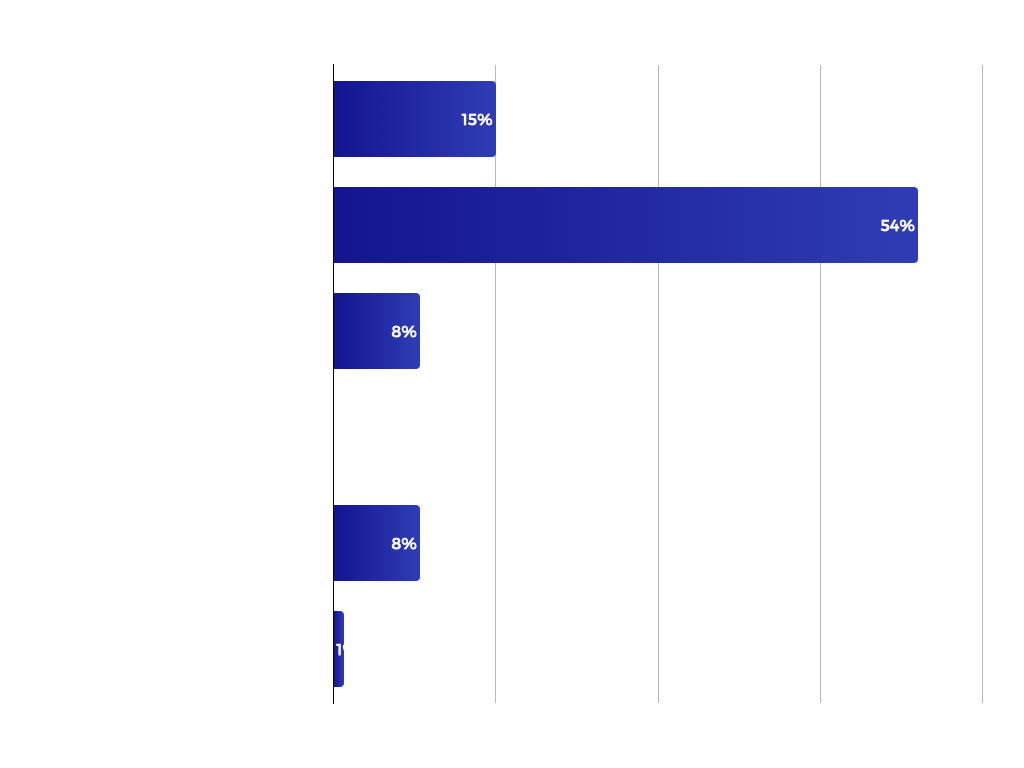

- Daniel Mc Carthy, Co-Founder at Theta educated the crowd on valuations with this talk on “Uncovering Hidden Valuation Insight through Predictive Customer Value Analysis”, followed by a poll on current valuations observed in the market.

- Poll no.1: What is the typical valuation range you are seeing for profitable Amazon FBA led brands?

- Poll no.2: What is the typical valuation range you are seeing for DTC led brands?

- Paul Hanley, Co-Founder at The Fortia Group brought the audience through our firms new Buy-side diligence offering. The Fortia Group have been servicing investors and credit funds but are now formalizing their Buy-side diligence offering, a rapid initial target screen. To learn more please contact The Fortia Group directly.

- Daniel McCarthy (Theta Equity), highlighted the need for more public market disclosures such as:

- Customer-based value metrics like cohorts.

- Active customers and order frequencies to wean ourselves off to.

- Revenue/EBITDA multiples all favor of the novel field of customer corporate based valuations.

03

Acquisitions

Participants

- Alex Lukashov, CEO of Fintent.

- Muddy Mat, Johannes Rossner [on behalf of Alpin Loacker and Project Boston).

- Daniel Mc Carthy, Co-Founder at Theta, Paul Hanley, Co-Founder at The Fortia Group and Withum CPAs.

Key Takeaways

- Our Shark Tank Brands Were A Big Success:

- Introducing Muddy Mat – Impressive omnichannel pet brand coming to market in Q1 2024. Matthew, Andrew and Ikho gave a fantastic demo and financial performance overview of the brand.

- Alpin Loacker – Patent protected EU based tech hiking clothing and equipment omnichannel brand.

- Project Boston, EU Headquartered Aggregator – US portfolio. This aggregator wishes to focus on their core business and as such are open to offers for their current US portfolio.

- To learn more about any of the above deals, please contact The Fortia Group directly.

- Daniel Mc Carthy, Co-Founder at Theta educated the crowd on valuations with this talk on “Uncovering Hidden Valuation Insight through Predictive Customer Value Analysis”, followed by a poll on current valuations observed in the market.

- Poll no.1: What is the typical valuation range you are seeing for profitable Amazon FBA led brands?

- Poll no.2: What is the typical valuation range you are seeing for DTC led brands?

- Paul Hanley, Co-Founder at The Fortia Group brought the audience through our firms new Buy-side diligence offering. The Fortia Group have been servicing investors and credit funds but are now formalizing their Buy-side diligence offering, a rapid initial target screen. To learn more please contact The Fortia Group directly.

- Daniel McCarthy (Theta Equity), highlighted the need for more public market disclosures such as:

- Customer-based value metrics like cohorts.

- Active customers and order frequencies to wean ourselves off to.

- Revenue/EBITDA multiples all favor of the novel field of customer corporate based valuations.

04

Value Creation

Participants

- William Holtz, Head of Data Operations at Source Medium.

- Naseem Saloojee, Co-Founder of Carbon6.

- Heath Barnett, Head of SMB & Growth, North America at Airwallex.

- CEO of EastWest, and further panelists: Rupesh Sanghavi , Founder & CEO at Ergode and Jim Stine, VP of sales at ShipPlug.

- Kevin Fischer, President of Kapoq and Bill Tauscher, CEO of Farallon Brands.

- Balaji Kolli Co-Founder of Saras Analytics and CFO Josh Holley of Bare Performance Nutrition.

- Jacob Cook, CEO of Tadpull.

- Jim Mann, VP of Europe at Getida, the CEO of The Mothership, Shawn Dougherty, the COO of Society Brands, and Joseph Falcao, CFO of Orva.

- Alex Urdea, founder of Deep Ocean Partners.

Key Takeaways

- Title sponsor Airwallex spoke about the importance of localised payment options and how this was going to be crucial as part of a hyper-localised targeting strategy for eCommerce today and into the future:

- Local payment methods accounted for 77% of transactions worldwide.

- 44% of consumers are likely to trust online shop that offers their preferred payment methods.

- The supply chain panel agreed that the rise of manufacturers going direct to the customer via marketplaces will continue to cause difficulties for eCommerce acquirors. It will be difficult to compete on price, however, as always obsessing over CX, branding and marketing strategy always have their place in combatting this type of competition.

- A common theme throughout value creation talks were the importance of visiting and developing relationships with suppliers globally. Often this can open up different credit terms or cost efficiencies over time.

- Predications for 2024 on supply chain were mixed as we move further from a covid container spike yet current situations in Suez Canal may continue to cause delays and additional cost.

- Kapoq and Carbon 6 explained that obsessing over performance metrics and investment benchmarking were crucial for brands and operators to double down on, with new Amazon marketplace fees forecasted to hit 2024, operators should be focusing on where they can make savings and efficiencies within the P&L.

- CFO Josh Holley brought this to life with insight into how his brand, Bare Performance Nutrition is optimizing with data support and help from Saras Analytics.

- Scrutinizing costs and ensuring you are setup for future success was a common theme, Bill Tauscher at Farallon Brands explained the importance of agility in retail, the role of eCommerce and marketplaces, and a view on timing when discussing growth plans with big retail. Bill cautioned the audience about some of the risks of entering the retail space too small, lacking purchasing and negotiating powers while having to invest large capital in trading agreements often just to remain on the shelf vs blue-chip competition.

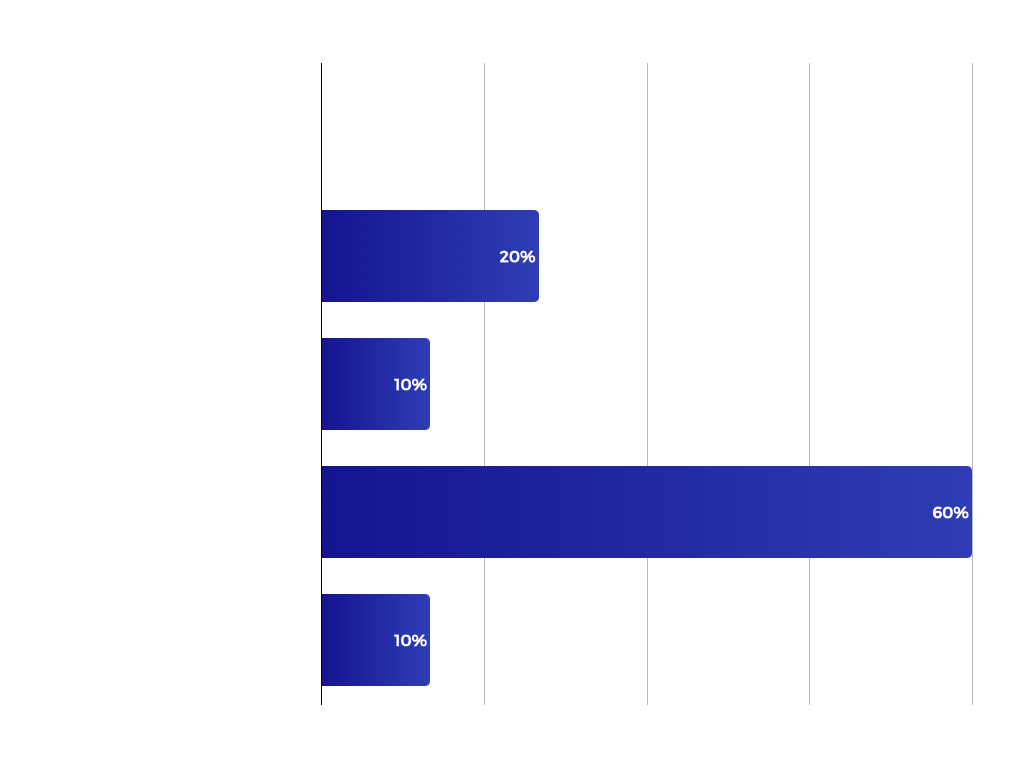

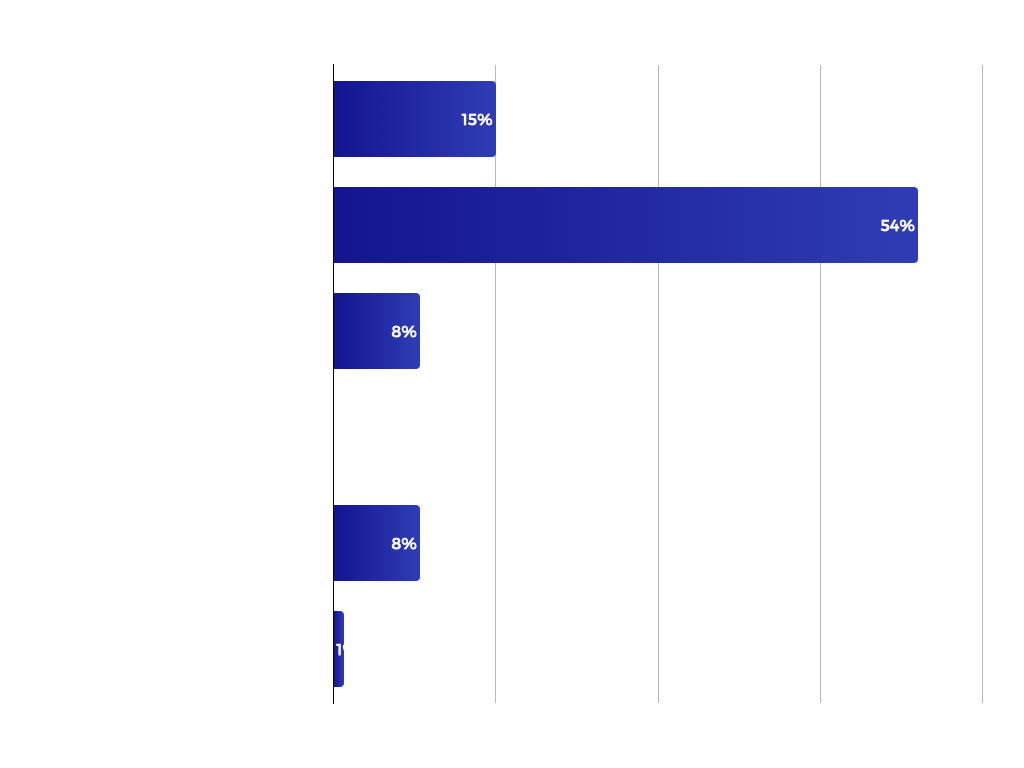

- Poll no.3: What is your top financial and operational priorities for 2024?

- Poll no.4: What is your target for corporate EBITDA margin by end of 2024?

- Poll no.4: What will drive the biggest valuation (profit multiple on exit / listing) of aggregators?

04

Value Creation

Participants

- William Holtz, Head of Data Operations at Source Medium.

- Naseem Saloojee, Co-Founder of Carbon6.

- Heath Barnett, Head of SMB & Growth, North America at Airwallex.

- CEO of EastWest, and further panelists: Rupesh Sanghavi , Founder & CEO at Ergode and Jim Stine, VP of sales at ShipPlug.

- Kevin Fischer, President of Kapoq and Bill Tauscher, CEO of Farallon Brands.

- Balaji Kolli Co-Founder of Saras Analytics and CFO Josh Holley of Bare Performance Nutrition.

- Jacob Cook, CEO of Tadpull.

- Jim Mann, VP of Europe at Getida, the CEO of The Mothership, Shawn Dougherty, the COO of Society Brands, and Joseph Falcao, CFO of Orva.

- Alex Urdea, founder of Deep Ocean Partners.

Key Takeaways

- Title sponsor Airwallex spoke about the importance of localised payment options and how this was going to be crucial as part of a hyper-localised targeting strategy for eCommerce today and into the future:

- Local payment methods accounted for 77% of transactions worldwide.

- 44% of consumers are likely to trust online shop that offers their preferred payment methods.

- The supply chain panel agreed that the rise of manufacturers going direct to the customer via marketplaces will continue to cause difficulties for eCommerce acquirors. It will be difficult to compete on price, however, as always obsessing over CX, branding and marketing strategy always have their place in combatting this type of competition.

- A common theme throughout value creation talks were the importance of visiting and developing relationships with suppliers globally. Often this can open up different credit terms or cost efficiencies over time.

- Predications for 2024 on supply chain were mixed as we move further from a covid container spike yet current situations in Suez Canal may continue to cause delays and additional cost.

- Kapoq and Carbon 6 explained that obsessing over performance metrics and investment benchmarking were crucial for brands and operators to double down on, with new Amazon marketplace fees forecasted to hit 2024, operators should be focusing on where they can make savings and efficiencies within the P&L.

- CFO Josh Holley brought this to life with insight into how his brand, Bare Performance Nutrition is optimizing with data support and help from Saras Analytics.

- Scrutinizing costs and ensuring you are setup for future success was a common theme, Bill Tauscher at Farallon Brands explained the importance of agility in retail, the role of eCommerce and marketplaces, and a view on timing when discussing growth plans with big retail. Bill cautioned the audience about some of the risks of entering the retail space too small, lacking purchasing and negotiating powers while having to invest large capital in trading agreements often just to remain on the shelf vs blue-chip competition.

- Poll no.3: What is your top financial and operational priorities for 2024?

- Poll no.4: What is your target for corporate EBITDA margin by end of 2024?

- Poll no.4: What will drive the biggest valuation (profit multiple on exit / listing) of aggregators?

05

Success Stories

Participants

- Shawn Dougherty, COO of Society Brands, Ken Kubec, Senior M&A Advisor at GoNorth, and Dan Fertig, VP of Agency & Technology Partnerships at BigCommerce.

Key Takeaways

- Society Brands have been gaining success with one of their brands by making key operational decisions including:

- Relocating parts of the supply chain.

- Building strong moats in market with an IP development strategy.

- explained how they focused on unit economics and margin contribution metrics which resulted in many pricing optimizations, increasing ASPs in order to hit target gross margin.

- GoNorth took us through a success story where a series of key decisions led quickly to an improvement in both revenue and net margins. GoNorth has been implementing both revenue-driving and margin-optimizing changes to a brand post-acquisition:

- Eliminated poor-performing ASINs post contribution margin analysis.

- A/B tested advertising strategies and cut off spending from non-performing ASINs.

- Shifted advertising spend to off-Amazon channels in order to drive high-converting traffic.

- Introduced 2 new products in time to capitalize on a Christmas seasonal demand spike.

- The results of these changes were impressive:

- Increased revenue +57% (revenue pre-changes was ~$10M for reference)

- Reduced TACoS from 9% – 5%.

- Reduced operating overhead required by reducing down portfolio and removing poor-performing ASINs.

- BigCommerce VP, Dan Fertig showed the audience how they have been equipping leading eCommerce brands with both the foundation and flexibility to succeed at a lower cost. BigCommerce has over 6,000 partners and 1,500 marketplace integrations.

- Dan explained how BigCommerce is a B2B solution and gave some interesting statistics about the B2B eCommerce environment:

- 90% of B2B buyers would turn to a competitor if the supplier’s digital channel couldn’t keep up with their needs.

- 87% of buyers would pay more for a supplier with an excellent eCommerce portal.

- Finally, Dan brought this to life with real-life case studies, showing how BigCommerce played a pivotal role in the tech stack and helped create operational efficiency, allowing lean internal eCommerce teams to operate multiple brands easily through BigCommerce storefronts.

- For any brand operators who are interested in having a FREE Google Feed Audit conducted by BigCommerce, please reach out to Dan Fertig at daniel.fertig@bigcommerce.com.

05

Success Stories

Participants

- Shawn Dougherty, COO of Society Brands, Ken Kubec, Senior M&A Advisor at GoNorth, and Dan Fertig, VP of Agency & Technology Partnerships at BigCommerce.

Key Takeaways

- Society Brands have been gaining success with one of their brands by making key operational decisions including:

- Relocating parts of the supply chain.

- Building strong moats in market with an IP development strategy.

- explained how they focused on unit economics and margin contribution metrics which resulted in many pricing optimizations, increasing ASPs in order to hit target gross margin.

- GoNorth took us through a success story where a series of key decisions led quickly to an improvement in both revenue and net margins. GoNorth has been implementing both revenue-driving and margin-optimizing changes to a brand post-acquisition:

- Eliminated poor-performing ASINs post contribution margin analysis.

- A/B tested advertising strategies and cut off spending from non-performing ASINs.

- Shifted advertising spend to off-Amazon channels in order to drive high-converting traffic.

- Introduced 2 new products in time to capitalize on a Christmas seasonal demand spike.

- The results of these changes were impressive:

- Increased revenue +57% (revenue pre-changes was ~$10M for reference)

- Reduced TACoS from 9% – 5%.

- Reduced operating overhead required by reducing down portfolio and removing poor-performing ASINs.

- BigCommerce VP, Dan Fertig showed the audience how they have been equipping leading eCommerce brands with both the foundation and flexibility to succeed at a lower cost. BigCommerce has over 6,000 partners and 1,500 marketplace integrations.

- Dan explained how BigCommerce is a B2B solution and gave some interesting statistics about the B2B eCommerce environment:

- 90% of B2B buyers would turn to a competitor if the supplier’s digital channel couldn’t keep up with their needs.

- 87% of buyers would pay more for a supplier with an excellent eCommerce portal.

- Finally, Dan brought this to life with real-life case studies, showing how BigCommerce played a pivotal role in the tech stack and helped create operational efficiency, allowing lean internal eCommerce teams to operate multiple brands easily through BigCommerce storefronts.

- For any brand operators who are interested in having a FREE Google Feed Audit conducted by BigCommerce, please reach out to Dan Fertig at daniel.fertig@bigcommerce.com.

In Partnership With

In Partnership With

Meet Theta, your new business oracle. Built by the foremost thought leaders, professors, data scientists, and statisticians behind the industry’s pre-eminent models and methodologies, and refined over hundreds of prior company analyses across dozens of industries, Theta delivers Customer Lifetime Value (CLV) and Customer-Based Corporate Valuation (CBCV) predictive analysis that companies and investment firms rely on to make key business decisions.

We are scientists and ecommerce marketers leveraging data to maximize performance with new and existing audiences. We listened to ecommerce teams, built software-based solutions, and now work daily to drive and scale revenue.

We are on a mission to punch through the mid-market revenue ceilings and redefine maximum growth for our partners while reducing dependency on third-party players.Control your future with software built by scientists and ecommerce marketing services managed by experts.

Meet Theta, your new business oracle. Built by the foremost thought leaders, professors, data scientists, and statisticians behind the industry’s pre-eminent models and methodologies, and refined over hundreds of prior company analyses across dozens of industries, Theta delivers Customer Lifetime Value (CLV) and Customer-Based Corporate Valuation (CBCV) predictive analysis that companies and investment firms rely on to make key business decisions.

We are scientists and ecommerce marketers leveraging data to maximize performance with new and existing audiences. We listened to ecommerce teams, built software-based solutions, and now work daily to drive and scale revenue.

We are on a mission to punch through the mid-market revenue ceilings and redefine maximum growth for our partners while reducing dependency on third-party players.Control your future with software built by scientists and ecommerce marketing services managed by experts.